Current State

Missouri’s legal cannabis industry has evolved rapidly since adult-use sales commenced in February 2023, making the state the fifth-largest adult-use market in the U.S. by 2024 with around $1.46 billion in total sales (adult-use ~$1.28 B, medical ~$181 M). Cannabis Business Times+2Green Blazer+2 The market remains robust into 2025, with monthly totals in the ~$117–$130 million range and year-to-date growth of ~6 % through April. NJCannaNews+2Highly Capitalized+2 Average item prices are relatively high (≈$27.53 in September 2025) which suggests Missouri consumers are willing to pay for premium products. Headset Overall, Missouri’s combination of moderate taxes (6% state tax on adult-use) and proximity to non-legalizing states has helped it punch above its population weight. FundCanna+1

Sales & pricing data:

Total sales in Missouri in September 2025: ~$118.16 million. Headset+1

Year-over-year growth for that period: +0.6% compared to Sept 2024. Headset

Month-over-month decline from August to September 2025: about –9.4%. Headset

Average item price in September 2025: ~$27.53. Headset

Sample category pricing (Sep 2025): Flower (per gram) ~$17.74 (+4.2 % YoY). Flower (eighth) ~$27.17. Edibles (100 mg) ~$15.36. Concentrate (gram) ~$35.44. Headset

Category-mix & growth trends:

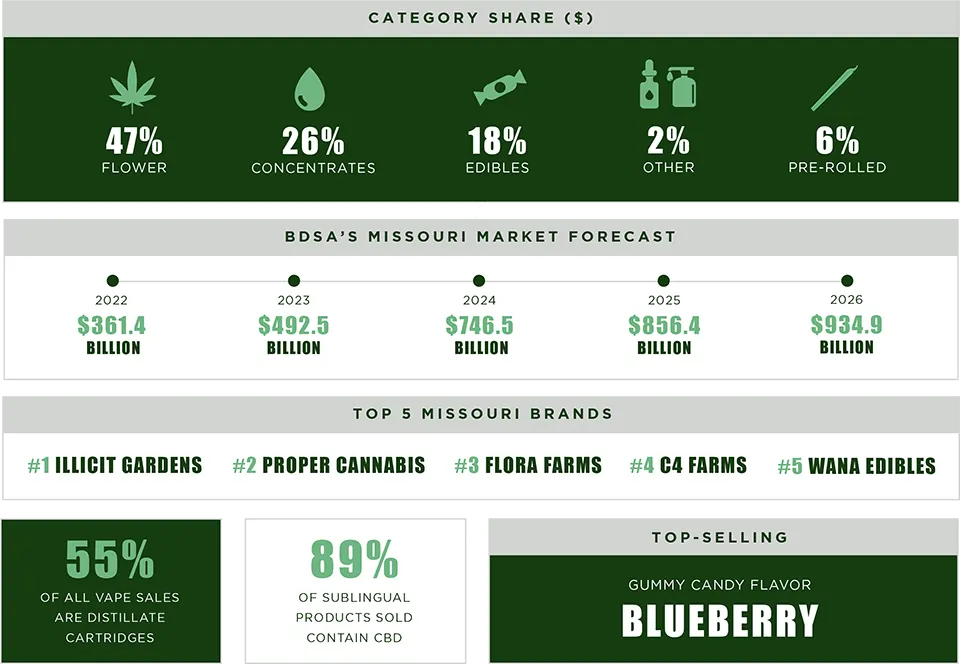

In Sep 2025: flower category sales ~$48.87 M (-9.1% YoY). Vapor pens ~$30.69 M (+9.8% YoY). Pre-rolls ~$16.5 M (+27.8% YoY). Edibles ~$15.2 M (+1.2% YoY). Concentrates ~$5.34 M (-11.6% YoY). Headset

In 2024 breakdown (approx): flower ~50% of total sales; vape carts ~22%; edibles ~14%; pre-rolls ~11% (which was noted as fastest-growing). Green Blazer

Medical-only channel has declined: e.g., medical monthly sales were about $24.1 M/month prior to adult-use launch, down to ~$15.1 M/month after. Cannabis Business Times+1

Key Factors Driving Sales

Premium pricing / consumer willingness – With average item prices above many states (~$27.53) and certain formats (eighths, concentrates) marked up, consumers in Missouri are showing willingness to pay for higher quality, branded or differentiated products. (As seen in the pricing data above.)

Format trends & innovation – Pre-rolls are a standout: strong YoY growth (~+27.8% in Sep 2025) suggests consumers are gravitating toward convenience formats. Vapor pens also show positive growth in contrast to some declines in flower and concentrates. This drives product selection decisions toward formats with momentum. Headset

Category saturation & competition – Flower remains dominant (≈50% share) but its growth is slowing or contracting (-9.1% YoY for flower in Sept 2025). That signals rising competition, potential price pressure, and a need for differentiation (e.g., infused pre-rolls, premium strains). Operators will select SKUs accordingly, focusing on cartridges, pre-rolls, branded lines, etc.

Out-of-state / border traffic – Missouri’s geography (bordering many states without adult-use legalization) gives it a potential influx of out-of-state buyers, which likely expands customer base and product mix. (Mentioned anecdotally in analysis sources.) https://www.ky3.com+1

Regulatory & license constraints influencing product supply – Missouri’s licensing system (capped/licensed cultivators, manufacturing) and moderate tax environment influence what products are viable, which in turn affects selection. Brands may focus on high-margin SKUs that justify distribution and shelf space. (From market overview) Green Blazer

Consumer behaviour / basket size & unit sales – Headset reports show basket size insights (e.g., ~$68.83 average basket size for Missouri in Sept 2023) and total units sold (e.g., 3.5 M units in Sept 2023) which informs product selection: operators will want SKUs that drive higher basket values and unit counts. Headset

Brand Update

Good Day Farm: Among the top‑selling brands in Missouri, especially strong in the pre‑roll/disposable and flower segments. According to Headset, in Missouri the brand achieved ~$1.17 M in sales for a recent month with ~58,964 units sold at an average item price of ~$19.82. Headset+2Greenway Magazine+2

CODES: Also rising in Missouri—Headset data shows ~$0.59 M in sales in the latest month with ~41,959 units sold at ~$14.05 average item price. Headset+1

Vibe Cannabis (MO): Strong in the specialty/extracts side and shown good rank mobility. Headset shows ~$0.30 M in sales in recent month (~12,524 units, avg price ~$24.35) in Missouri. Headset+1

Rove: Well‑positioned in the vape/disposable category in Missouri. Headset shows ~$0.67 M in sales for a recent month with ~19,278 units sold at ~$34.99 avg item price. Headset+1

Kushy Punch: Dominant in the disposable vape category. A recent ranking lists it as #1 in Missouri for total vape sales (~$9.86 M) in a recent period, ahead of other major brands. Ciliconplus

Rooted (MO): In the flower category, Headset data shows the brand ranking 11th (later 12th) in Missouri by September 2025, indicating a solid mid‑tier position in flower. Headset

| Additional | Notes: |

|---|

| Average item price (Sep 2025) | ~$27.53 | Indicates premium pricing environment. Headset |

| Total sales (Sep 2025) | ~$118.16 M | +0.6% YoY growth. Headset+1 |

| Pre-roll sales (Sep 2025) | ~$16.5 M | +27.8% YoY growth. Headset |

| Flower category sales (Sep 2025) | ~$48.87 M | -9.1% YoY decline. Headset |

| Daily average sales (March 2025) | ~$4.22 M/day | Growth over previous year. St. Louis Argus |

| 2024 total sales | ~$1.46 B | 5th largest adult-use market. Cannabis Business Times+1 |

Cannabis Business Times

Missouri Now 5th Largest Adult-Use Cannabis Market in Nation | Cannabis Business Times- NJCannaNewsMissouri Cannabis Sales Maintain Upward YoY Growth

Headset

Missouri Cannabis Prices and Trends | HeadsetFundCanna

Missouri: The Heartland’s Budding Cannabis Opportunity | FundCannaGreen Blazer

Missouri Cannabis Market Overview : 2024 Performance and 2025 Outlook – Green Blazerhttps://www.ky3.com

By the numbers: Missouri’s marijuana industry at the end of 2023 debut of recreational salesHeadset

Missouri Cannabis Market DataSt. Louis Argus

Missouri Celebrates Record-Breaking Recreational Marijuana Sales in March – St. Louis Argus

- More

missouristatecannabis.org

Missouri Marijuana Sales Report 2025 | MissouriStateCannabis.orgMISSOURI MARIJUANA SALES REPORT 2025 1. Missouri Cannabis 2. Cannabis Business in Missouri 3. Annual Cannabis Sales and Trends in Missouri ANNUAL CANNABIS SALES IN MISSOURI Cannabis sales in Missou…highlycapitalized.com

Missouri Cannabis Sales Fall to $118.9M in September – Highly CapitalizedThursday, October 16, 2025 We Follow The Money. MISSOURI CANNABIS SALES FALL TO $118.9M IN SEPTEMBER 1.8 min readPublished On: October 16th, 2025By HCN News Team ST. LOUIS – Retailers in Missouri…cannabisindustrydata.com

Missouri Dispensaries Reported Over $124 Million In Sales For March 2024Image: St Louis Arch Missouri Archway MISSOURI DISPENSARIES REPORTED OVER $124 MILLION IN SALES FOR MARCH 2024 Apr 10, 2024 — by Johnny Green in Geographical Data On Election Day 2018, voters i…cannabisindustrydata.com

Missouri’s Recreational Cannabis Industry Nears $3 Billion In Total SalesImage: st louis missouri arch MISSOURI’S RECREATIONAL CANNABIS INDUSTRY NEARS $3 BILLION IN TOTAL SALES Aug 9, 2025 — by Johnny Green in Geographical Data Voters in Missouri first approved adul…cannabisindustrydata.com

Missouri’s Legal Cannabis Industry Sold $119.58 Million Worth Of Products In June 2024Image: Kanasas City Missouri MISSOURI’S LEGAL CANNABIS INDUSTRY SOLD $119.58 MILLION WORTH OF PRODUCTS IN JUNE 2024 Jul 13, 2024 — by Johnny Green in Geographical Data Missouri’s licensed canna…industryresearch.biz

Missouri Medical Cannabis Market Share & Trends [2034]Request Free Sample PDF MISSOURI MEDICAL CANNABIS MARKET SIZE, SHARE, GROWTH, AND INDUSTRY ANALYSIS, BY TYPE (BUDS,TINCTURES,OIL), BY APPLICATION (CHRONIC PAIN,MENTAL DISORDERS,CANCER,OTHERS), REGION…headset.io

Vertical (MO) Cannabis Sales DataVERTICAL (MO) DATA SNAPSHOT: OCT 06, 2025 $500K+ SEP-2025 Sales Strong Growth TREND 6-Month 191 PRODUCT COUNT SKUs Vertical (MO) OVERVIEW Get More Data Markets VERTICAL (MO) LOCATIONS…mjbizdaily.com

Total marijuana sales in Missouri up nearly 5% from April 20241. Home 2. / 3. Retail By MJBizDaily Staff May 16, 2025 Join us for MJBizCon, happening Dec. 2-5, 2025. Registration is open. https://mjbizconference.com/registration-packages-pricing/ * * * Sale…mjbizdaily.com

Missouri marijuana stores set monthly sales mark at $124.7M in March1. Home 2. / 3. Retail By MJBizDaily Staff April 15, 2024 – Updated April 15, 2024 Join us for MJBizCon, happening Dec. 2-5, 2025. Registration is open. https://mjbizconference.com/registration-pac…cannabisbenchmarks.com

Missouri Marijuana Market Joins the $1 Billion Total Sales Club – Cannabis Benchmarks®Image: Missouri Marijuana Market Joins the $1 Billion Total Sales Club Image: Diyahna Lewis/Unsplash March 12, 2024 The Missouri Department of Health (MDH) recently issued December 2023 medical and…- mocanntrade.orgEconomic Impact of Missouri CannabisSkip to Main Content MISSOURI: THE LITTLE MARKET THAT COULD Sometimes, the headlines really do say it all: “HOW MISSOURI BECAME A CANNABIS MECCA” ~ Wall Street Journal “NEWCOMER MISSOURI SURPASS…

mogreenway.com

Missouri poised to be nation’s 6th largest legal cannabis market with more than $470 million sold in first 4 months — Greenway MagazineMISSOURI POISED TO BE NATION’S 6TH LARGEST LEGAL CANNABIS MARKET WITH MORE THAN $470 MILLION SOLD IN FIRST 4 MONTHS * MoCannTrade * June 9, 2023 According to the Missouri’s Division of Cannabis Regu…mogreenway.com

Analysis: State of the Missouri cannabis industry — Greenway MagazineANALYSIS: STATE OF THE MISSOURI CANNABIS INDUSTRY * Brendan Mitchel-Chesebro, Analyst, Industry Intelligence, BDSA * March 29, 2023 Despite uncertain market conditions and unprecedented challenges,…marijuanamoment.net

Missouri Marijuana Sales Hit $126 Million In March, State Data Shows, With Market Expected To Reach $1 Billion By Year’s End – Marijuana MomentConnect with us Missouri marijuana sales reached a record $126 million in marijuana sales in March, the second month since adult-use shops opened in the state after voters approved legalization at th…kctv5.com

Recreational use marijuana sales become Missouri’s newest billion dollar industry in 2023KANSAS CITY, Mo. (KCTV) – Missouri dispensaries cashed in on marijuana sales during the first 11 months- Citations

- More

mogreenway.com

Missouri brands stand tall on national pre-roll leaderboard — Greenway MagazineMISSOURI BRANDS STAND TALL ON NATIONAL PRE-ROLL LEADERBOARD * Nicole Williams and Sam Lynch * June 18, 2025 UPDATED Missouri’s cannabis market continues to assert its strength on the national stage…mogreenway.com

Missouri brand named No. 1 selling cannabis flower in America — Greenway MagazineMISSOURI BRAND NAMED NO. 1 SELLING CANNABIS FLOWER IN AMERICA * SHOW-ME ORGANICS * December 16, 2024 Vivid Cannabis combines quality products with creative marketing to lead the way. Vivid’s Florid…ciliconplus.com

Missouri’s Best: Top 10 Best-Selling Concentrates and BrandsHome > Learn > Missouri’s Best: Top 10 Best-Selling Concentrates and Brands > MISSOURI’S BEST: TOP 10 BEST-SELLING CONCENTRATES AND BRANDS Updated on July 22, 2025 Missouri’s cannabis market is ra…franklinsmo.com

Franklin’s Named #1 Blunt Brand in the U.S. by Headset.Skip to content 0 Your cart is empty Continue shopping Kansas City, MO — Franklin’s, the Kansas City-based cannabis brand renowned for its slow-burning, ultra-potent, and always fresh blunts, has…headset.io

Best Selling Cannabis Flower in Missouri | HeadsetTHE BEST SELLING CANNABIS FLOWER IN MISSOURI DATA SNAPSHOT: OCT 11, 2025 MISSOURI FLOWER Top 10 Products Rank Brand Product Avg. Price Sales (30day)* 4Member Berry (3.5g)CODES$22.36 5Diese…headset.io

Best Selling Cannabis Edible in Missouri | HeadsetTHE BEST SELLING CANNABIS EDIBLE IN MISSOURI DATA SNAPSHOT: OCT 11, 2025 MISSOURI EDIBLE Top 10 Products Rank Brand Product Avg. Price Sales (30day)* 5Indica Cherry Limeade Mega Pearl Gummi…headset.io

Best Selling Cannabis Capsules in Missouri | HeadsetTHE BEST SELLING CANNABIS CAPSULES IN MISSOURI DATA SNAPSHOT: OCT 11, 2025 MISSOURI CAPSULES Top 10 Products Rank Brand Product Avg. Price Sales (30day)* 2CBD/THC 1:1 Bliss Tablets 20-Pack…- mocanntrade.orgMoCannTrade | Missouri’s Pre-Roll Market: A Comprehensive Analysis of Trends and RegulationsSkip to Main Content Image: Missouri’s Pre-Roll Market: A Comprehensive Analysis of Trends and Regulations Since launching its adult-use cannabis market in 2023, Missouri has quickly established its…

herb.co

Where to Find the Best Weed in Missouri: Edibles, Vapes, Flower & More | HerbThis app works best with JavaScript enabled. advertise with herb Subscribe advertise with herb advertise with

- Flavonoids & Terpenes in Cannabis – November 20, 2025

- MO | Industry Update Q3 2025 – October 28, 2025